- What are the particularities of risk management for hydrogen projects?

- What are the issues and problems on the market that are caused by inadequate risk management for hydrogen projects?

- What are the drivers of such issues?

- How to identify and deal with the risks?

- What are the key takeaways from risk management for hydrogen projects?

Browse all risk management services from leading suppliers on our marketplace!

What are the particularities of risk management for hydrogen projects?

Hydrogen production or usage is inherently a risky business. There is a multitude of factors that make it different from other energy projects. One of the main factors is that we are using technologies and value chains that are completely new at scale.

There are of course risks that are well known and very distinct but still need careful consideration, such as the handling of hydrogen due to its properties. The recent explosion and fire caused in July 2023 in California is a reminder that there is no 0 risk.

There are however some less particular issues to hydrogen, such as corporate, project management and economically related aspects to hydrogen projects. Examples can be found in the many projects being delayed such as the pulling out of shell hydrogen refueling stations (HRS) in the UK, Fortescue Metals losing its partner in their Queensland project in January 2023, or more generally IPCEI projects in Europe being setback due to public funding delays. These are common project influences in energy and even other industries. However, the particularity to hydrogen is that project factors are exacerbated by hydrogen being relatively new in many fields, lack of or stalling regulation, new technologies and new players on the market. It makes it harder to know what to choose, from whom and when.

All in all, hydrogen is on a de-risking journey, and it remains key to be on the right side of that journey when developing and working on projects.

What are the issues and problems on the market that are caused by inadequate risk management for hydrogen projects?

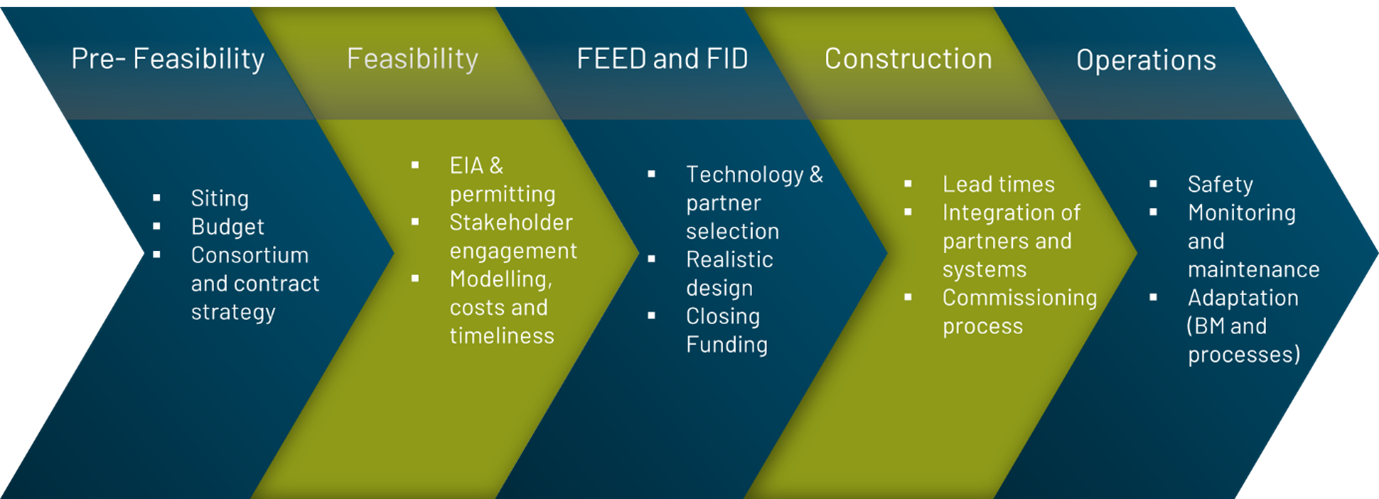

Building upon some of the examples above, some of the key issues with a project can occur at different stages of the project development and most of these can be dealt with appropriate project risk management.

In the different stages of the project, the following key aspects are common issues that will be root causes for delays, budget overruns or projects stopping altogether. There are of course many more aspects, but from our experience, it seems that some of these might be the main ones.

a) Pre-feasibility phase

- Siting: the most important base for the project, it determines the offtake renewable resource or hydrogen supply availability and potential to scale up. Siting can also offer more subtle support to projects depending on the country, region or locality that might offer subsidies and tax advantages.

- Budget: Often too optimistic a careful budget with a realistic timeline is crucial to not run into cost overrun and needing to extend capital raising rounds that might prove to be unsuccessful due to the drop in confidence from being far from budgeted targets.

b) Feasibility phase

- EIA and permitting: An often-overlooked part of the feasibility stage is to engage as early as possible with the permitting authorities and communities to allow for a smoother process after.

- Stakeholder engagement: NIMBY is a common factor that can arise from communities, alternative solution providers or politicians. Engaging early, educating and bringing people to the table as early as possible is crucial. Furthermore, low-carbon hydrogen projects being an economically viable solution, for the large portion of them with subsidies, means it requires political support and alignment to secure funding, grants and other forms of financial backing.

c) FEED and FID

- Technology and partner selection: In a world where new technologies and new providers are popping up at a very accelerated pace unless some guarantees from those providers can be secured contractually (very difficult talking from experience), then the best solution will always be to go with proven track records and technologies.

- Realistic design: It remains difficult to keep a realistic design, especially in large consortiums where system integration is key. Digital twins can help model designs in great detail and can be worth looking into to make sure the design matches the needs of production or supply.

d) Construction:

- Lead times: We are living in a new changing world order that is switching from global supply chains and just-in-time deliveries to a less interdependent trade system and disrupted supply chains. Until those stabilise and manufacturing capacity is built up for technologies like electrolysers, the lead times need to be considered in the project as an as is situation and not a hopeful one.

- Partner and system integration: partners within a project are all bringing something to the table with their own knowledge, expertise, and technology. However, it is important to recognise disparities and to close those gaps as soon as possible. If two digital systems need to talk to each other this should be considered in the order not after.

e) Operations

- Safety: Smooth operations require a no-laissez-faire attitude towards safety and although that might be evident, time again human error is at the centre of risk for safety. Continuous training and going above and beyond standards will help avoid catastrophic failure.

- Adaptation: a business model and value chain that works today might not be tomorrow. Having relied on one large off-taker might not have been the best decision if they contractually can move away from the supply agreement and choose a different supplier after 10 years. Being able to adapt, scale up and change business models and potential value chains at a moment’s notice is crucial for the longevity of the hydrogen project.

What are the drivers of such issues?

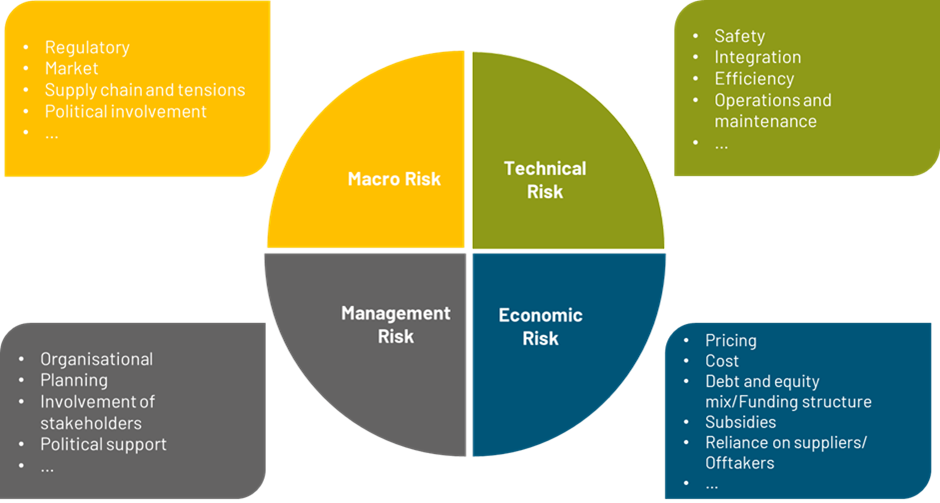

As far as we see risk we have categorized and subcategorized risks in hydrogen production and usage projects under the four main groups:

- Macro risks: mostly due to political and regulatory spheres of influence.

- Technical risk: in large played by the roles of technologies, safety and operations.

- Management risk: overarching project development, stakeholder engagement and planning for the project.

- Economic risk: ranging from pricing and costs to offtake and supply issues.

All the project risks can be broadly driven by these main groups of risk. Being aware of them remains a key to success.

How to identify and deal with the risks?

To identify and mitigate risks there is no need to reinvent the wheel and standard risk management practices can be used at a project level. HAZOP frameworks and beyond are of course useful when talking about safety for example, but generally, we can take standard practices of project risk management and apply them to hydrogen projects.

A good framework might be the following:

- Establish Risk Management Objectives

- Identify the Risks

- Analyse and Evaluate

- Manage risks

- Record and report

- Monitor and update

With this in mind, tools can be used to implement this such as risk templates, risk assessment tools for the analysis and risk registers to manage, record, report as well as monitor.

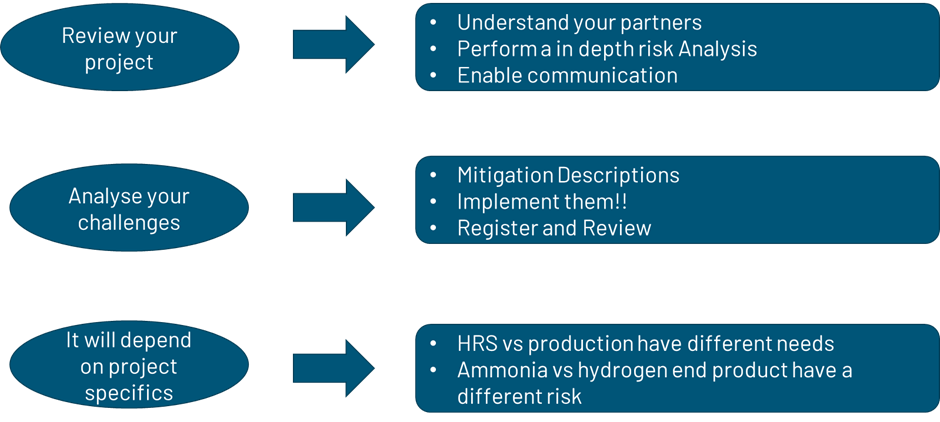

At the early stages of a project, some simple concrete steps can be taken to deal with some key issues as depicted in the graphic hereunder. It boils down to making sure realistic data, timelines and early engagement is enabled and implemented.

The financing perspective is also key, BCG (2023) identified 4 risks from the perspective of financiers that will be enablers to gather a pool of funding possibilities.

- Have long-term offtake agreements with good quality counterparties (offtake risk)

- Use mature technologies (technology risk)

- Operate under clear regulations and industry standards (policy risk)

- Be able to sell into established markets (merchant risk)

Bringing real world data and documented agreements (if possible, on the long term), government backing, proven technologies and risk sharing proof to the table will help bring the financing needed to reach FID.

What are the key takeaways from risk management for hydrogen projects?

In short, risk management for hydrogen projects needs to be broad due to long value chains and many partners being involved. Having all partners share experience and expertise with one another will be key to the success of each project. On the other hand, depth of detail is imperative. We are all dealing with unknowns no matter how big the project sponsors and developers might be, there will be some knowledge gaps. Understanding each system in depth is central to strong risk management. Externalising some parts for some technologies or aspects the project developers might be required for the best outcomes.

Furthermore, it is all good to identify and analyse risks, but concrete efforts to implement the mitigation measures and monitor their effects remains something that be it sometimes harder, but needs to be done.

Content contributed by Cratos GmbH

In 2009 CRATOS GmbH was first set up as a consultancy with a strong focus on project management and IT topics. Hydrogen and energy have become a core part of the CRATOS portfolio. Their future-oriented vision and enthusiasm about technology with the clear goal of shaping change towards ecological and economic sustainability is always at the center of their enterprise. CRATOS’ portfolio aims to develop, plan, implement and optimize your energy solutions and ideas together with you.

Last update: 11.09.2023